Investor Views on AI Oversight: What Do Proxy Votes Tell Us?

Key Observations

- This research paper examines 15 recent shareholder resolutions at US companies addressing oversight and transparency over the use of artificial intelligence.

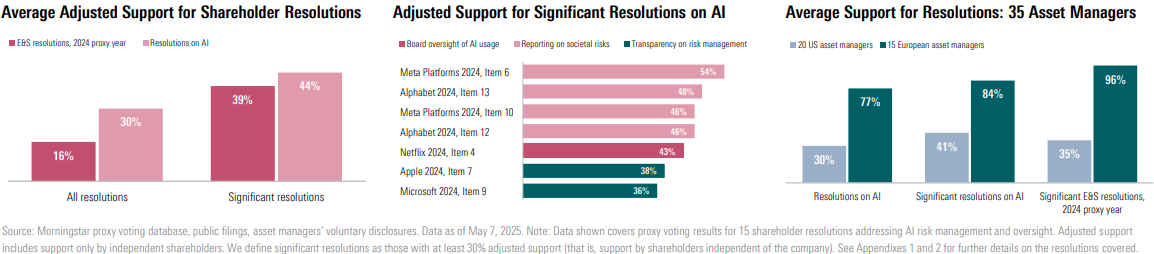

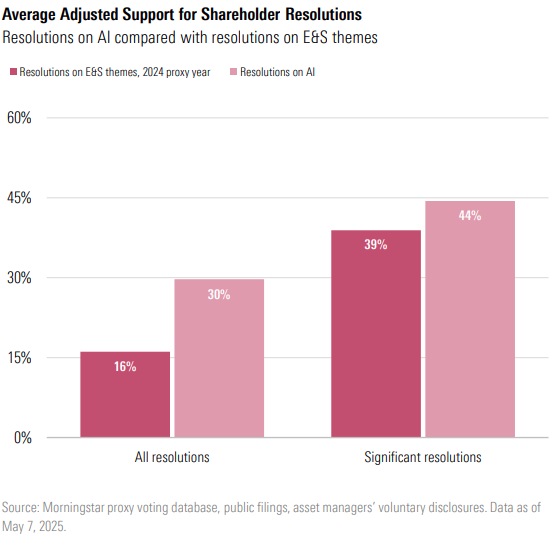

- On average, shareholder support for resolutions on AI has exceeded support for proposals on other environmental and social themes.

- Average adjusted support for the 15 resolutions on AI is 30%, almost double the support for the 400 E&S resolutions in the 2024 proxy year (16%). The seven significant resolutions also achieved higher average support than 107 significant E&S proposals in 2024.

- Twelve of the 15 resolutions were filed at just five Big Tech companies: Alphabet, Amazon, Apple, Meta Platforms and Microsoft. Chipotle Mexican Grill, Netflix and Warner Bros. Discovery also featured.

- The four most successful resolutions on AI targeted the same two issues (misinformation and disinformation, and AI-driven targeted advertising) at two companies: Meta Platforms and Alphabet.

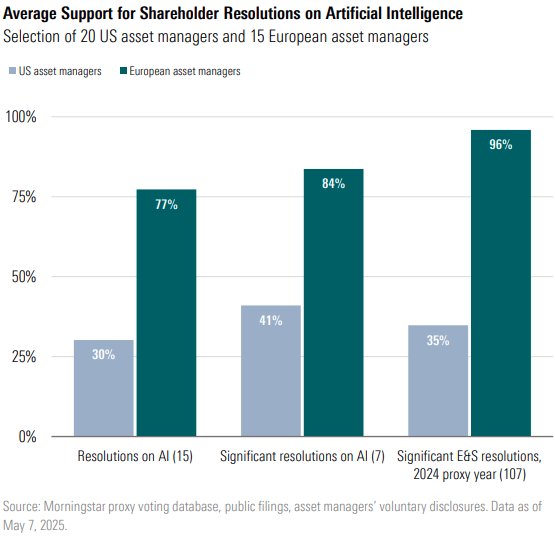

- As with E&S themes more generally, US and European asset managers are taking very different approaches to voting on resolutions addressing AI.

- Average support for AI resolutions among the 20 US asset managers we reviewed was 30% – less than half the 77% observed for 15 European peers. The gap for significant resolutions is narrower.

- In the US, BlackRock supported only one of the 15 proposals (7%), State Street and Vanguard did not support any. Fidelity, MFS, and Principal were the strongest US supporters of AI proposals (all 70%+).

- In Europe, Allianz GI, Amundi, Candriam, and Nordea supported all 15 resolutions. The lowest level of support by a European asset manager was 43%

Shareholder Resolutions on AI

Results for 15 recent shareholder resolutions indicate that AI oversight is becoming a key issue for shareholders.

Shareholder Support for Resolutions on AI Exceeds That for Environmental and Social Themes Overall

Investors who pay close attention to environmental, social and governance factors are also increasingly taking notice of AI. Of particular interest to them is the way company boards are ensuring robust risk management and oversight is in place to control the impacts of this powerful new technology.

Over the last year and a half, a number of shareholder resolutions on AI oversight have started to turn up on corporate proxy ballots. This research paper examines the proxyvoting results for 15 such resolutions: 11 in the proxy year ended June 30, 2024, and four in the first nine months of the 2025 proxy year (up to March 31). All 15 resolutions were filed at US companies.

Overall, we found that shareholder resolutions on AI have gained stronger shareholder support than recent resolutions on E&S topics generally. Average adjusted support for the 15 shareholder proposals on AI (30%) is almost double that for the 400 E&S proposals in the 2024 proxy year (16%).

Looking only at significant resolutions (those supported by at least 30% of independent shareholders), AI resolutions remain better supported but to a lesser extent. Average adjusted support for the seven best-supported AI resolutions (41%) remains above the average for the 107 significant E&S resolutions in the 2024 proxy year (39%).

Fifteen Shareholder Resolutions on AI Show Varying Degrees of Success

Twelve of the 15 resolutions we analyzed were filed at just five Big Tech companies: Alphabet, Amazon, Apple, Meta Platforms and Microsoft. Media companies Netflix and Warner Bros. Discovery also held votes on AI oversight, with Chipotle Mexican Grill also holding a vote on the impacts of AI and automation on its workforce. We have split the resolutions into three themes.

- Board oversight of AI usage: four of the 15 proposals specifically requested information on, or changes to, the board’s role in overseeing AI activities.

- Reporting on societal risks: seven of the 15 proposals requested information on risks to communities external to the company that could result from the company’s use of AI, particularly human rights risks or risks relating to misinformation and disinformation.

- Transparency on risk management: four of the 15 proposals requested additional disclosure about the company’s approach to risk management related to AI, including policies and ethical guidelines.

The proposals experienced varying degrees of success, with no single theme dominating the more successful significant proposals. The four most successful resolutions on AI achieved adjusted support of 45% or more. They targeted two issues – misinformation and disinformation risks, and AI-driven targeted advertising – at Meta Platforms and Alphabet. Overall, there were seven significant resolutions (those with adjusted support of 30% or more). Besides the four mentioned above, two addressed risk management transparency, and one focused on board oversight of AI.

Asset Manager Voting Trends

Asset managers in the US and Europe have taken different approaches to voting on resolutions on AI.

US Asset Managers’ Support for Resolutions on AI is Lower Than Their European Peers

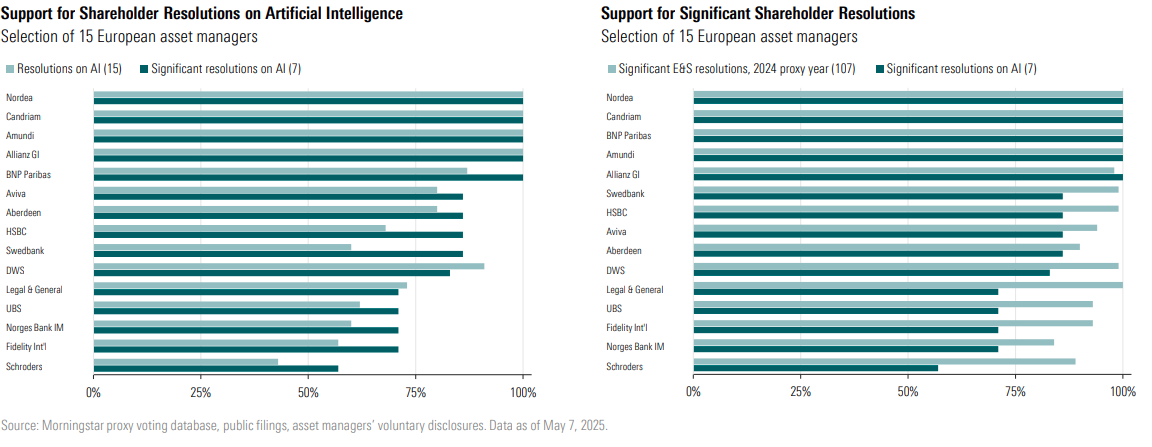

We examined voting results on the 15 shareholder resolutions for 35 asset managers: 20 in the US and 15 in Europe. (See Appendix 2 for full voting records.) Our previous research has shown that European asset managers are considerably more likely to support E&S shareholder resolutions than those in the US. This also appears to be true for resolutions on AI, as the chart opposite shows.

Average support for the resolutions on AI by the US asset managers we reviewed was 30%. This corresponds to the overall average adjusted support for these 15 resolutions, but it is less than half the 77% average support observed for the 15 European asset managers. The gap narrows somewhat if we look only at the significant resolutions: US asset managers’ average support for these seven resolutions stood at 41%, compared with 84% among the European asset managers. It is noteworthy that the US asset managers’ average support for significant resolutions on AI exceeds their recent support for significant E&S resolutions in general. US asset managers support for 107 significant E&S resolutions in the 2024 proxy year averaged 35%. Amid a recent pullback in US asset manager support for E&S resolutions, the result suggests that they see oversight of AI as a more financially material issue than many other E&S topics addressed by shareholder resolutions.

In contrast, the European asset managers’ support for resolutions on AI, although very high at 84%, is lower than their near total support (96%) for significant E&S resolutions. Based on this, it appears that European asset managers consider AI risk oversight to be a more nuanced voting matter compared with other, more mainstream E&S topics like climate, human rights, or labor relations.

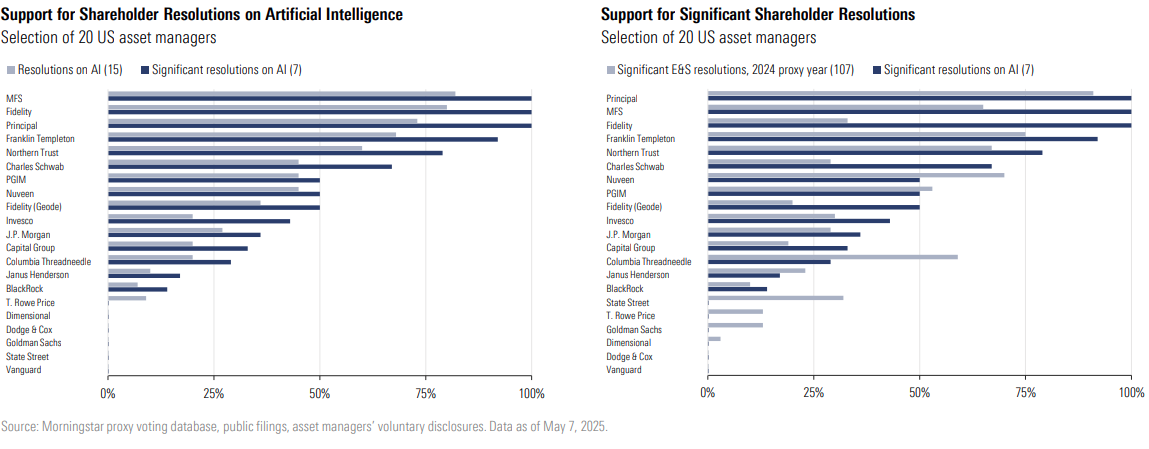

US Asset Managers’ Support for Resolutions on AI Spans A Wide Range

The 20 US asset managers’ support for resolutions on AI varied greatly, with a range of 0% to 82%. MFS, Fidelity, and Principal showed the highest support among the 20 managers, each backing more than 70% of the proposals they voted on. The very largest firms’ support for these resolutions tends to be low, reflecting their growing reticence to support shareholder proposals. Five asset managers – Dimensional, Dodge & Cox, Goldman Sachs, State Street, and Vanguard – did not support any of the AI resolutions they voted on. BlackRock supported only one of the 15 resolutions (7%).

European Asset Managers Tend To Support Most Resolutions on AI

European asset managers’ support for resolutions on AI varied less than their US peers. The 15 asset managers we reviewed showed moderate to high support across the board. All showed higher support for resolutions on AI than the average for their US peers. Four asset managers – Amundi, Allianz Global Investors, Candriam, and Nordea – supported all of the AI resolutions they voted on. The three European institutions with the lowest support for AI-related proposals – Fidelity International, Norges Bank Investment Management, and Schroders – still backed between 40% and 60% of the resolutions they voted on.

Key Observations from Voting Rationales

A number of asset managers have published rationales explaining their voting decisions on the 15 resolutions on AI. This is a more common practice among European asset managers than in the US. The rationales reveal some key recurring themes that help explain investors’ views on AI risk management. (See Appendix 2 for transcripts of selected asset manager voting rationales.)

Recurring Themes in Rationales From Asset Managers That Voted “For”

- Where asset managers have supported resolutions requesting additional reporting, it is common to see them acknowledge the usefulness of existing company disclosures while noting that further disclosures requested by the proposal would aid shareholders’ understanding of material risks.

- Where asset managers have supported resolutions on board oversight of AI, they have tended to state that the proposal’s adoption would enhance material risk oversight in a way that permits the company to exercise discretion in its implementation.

Recurring Themes in Rationales From Asset Managers That Voted “Against”

- As with many shareholder proposals, it is common to see asset managers mention that they believe the company’s existing policies and practices are considered sufficient to manage the risks, or that current disclosures keep shareholders adequately informed.

- In some cases, asset managers who voted “Against” stated that they found the proposal in question to be overly specific or unduly burdensome on the company. Less frequently, some mentioned that certain proposals risked disclosure of commercially sensitive information.

- We found no examples of rationales on these resolutions on AI where asset managers stated that the issue was not material from their point of view.

Link to the full report can be found here.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release